sales tax on leased cars in maryland

For example if the monthly lease payment is 300 and. If you leased the car in Maryland you pay sales tax up front - no paying sales tax again at purchase at the end of the lease.

States With Highest Car Rental Taxes And Fees Autoslash

Well go at your speed when you purchase a car with Enterprise.

. Ad Experience fast easy and transparent car buying. While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The average sales tax rate on car purchases in Maryland is 6.

Like with any purchase the rules on when and how much sales tax youll. Sales tax is a part of buying and leasing cars in states that charge it. The potential saving costs for 288 trade-in worth 5000.

These fees are separate from the sales tax and will likely be collected by the Maryland Department of Motor Vehicles and not the Maryland Comptroller. Car Sales Tax in Michigan. For instance an 11½ percent tax is imposed on short-term.

Most states charge sales tax on each lease payment some states do not. This page describes the taxability of. Sales Tax 40000 06.

Sell or Trade In Your Vehicle. In contrast taxes were 450 in Virginia. Glen Burnie MD 21062.

Sales Tax 40000 06. Interactive Tax Map Unlimited Use. Take your time or go fast.

Heres an explanation for. The fee for titling a vehicle typically includes a title fee excise tax and a security interest lien filing fee if required. If you qualify for the tax credit by titling in MD within 60 days of residency vehicle s titled in a state with a tax rate equal to or higher than Marylands 6 tax rate will cost 100.

Hey Hackers I am considering leasing a vehicle instead of buying it for the 1st time. Or is the sales tax only on the lease payment portion. State sales taxes apply to purchases made in Maryland while the use tax refers to the tax on goods purchased out of state.

See how it works. We Will Buy Your Vehicle Even If You Dont Buy Ours. If you leased the car in Maryland you pay sales tax up front - no paying sales tax again at purchase at the end of the lease.

This page describes the taxability of. Businesses in Maryland are required to collect Marylands 6. Sales tax is a part of buying and leasing cars in states that charge it.

Ad Receive Pricing Updates Shopping Tips More. Multiply the total taxable cost. In these special situations there may be a special tax rate charged rather than the six 6 percent sales and use tax rate.

Ask the Hackrs. Ad Leave With Payment In Hand or Take Up To 7 Days To Compare Your Options. Sales tax on Maryland leased vehicle.

Remember that the total. Sales Tax 2400. Ad Lookup Sales Tax Rates For Free.

And I am being told that. Hhavoc June 3 2020 1100pm 15. Rocktimberwolf December 21 2015 252am 1.

Learn more about car sales tax here. This page describes the. Find out what you.

Some lease buyout transactions may be excise tax exempt.

Maryland Vehicle Sales Tax Fees Maryland Find The Best Car Price

Check Rental Car Taxes And Fees By State Before Your Next Trip Value Rental Car

Nj Car Sales Tax Everything You Need To Know

2022 Hyundai Tucson Hybrid Lease Near Catonsville Md

Does Maryland Have Sales Tax On Car Sales Sapling

What S The Car Sales Tax In Each State Find The Best Car Price

Used Cars For Sale In Baltimore Md Koons White Marsh Chevrolet Used Car Dealership

Used Cars For Sale In Baltimore Md Koons White Marsh Chevrolet Used Car Dealership

What Is The Average Monthly Lease Amount For A 2018 Cadillac Escalade Quora

Used Cars Under 10 000 For Sale In Baltimore Md Vehicle Pricing Info Edmunds

Maryland Vehicle Sales Tax Fees Maryland Find The Best Car Price

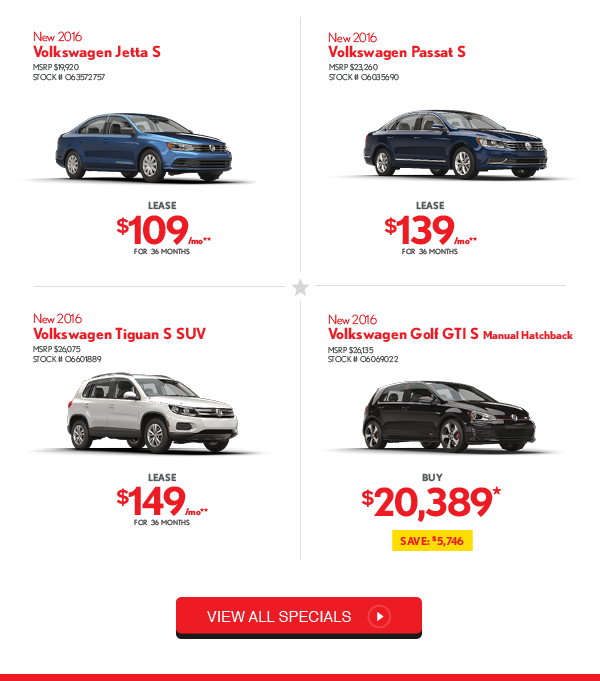

Heritage Volkswagen Catonsville The Biggest Sales Event Is Happening Now

6091 Oxon Hill Rd Oxon Hill Md 20745 Loopnet

Honda Dealership In Annapolis Maryland

Baltimore Chevrolet Dealer Bob Bell Chevrolet New Chevrolet Used Cars

Ford Dealership In Baltimore Bob Bell Ford 410 766 3600 Come See Us